Money is the number one problem people in their 20´s struggle with.

During the years we attend school, no one ever teaches us how to do our taxes, apply for a college loan, to write a check, or to create a budget for personal reasons. Many learn from their parents, but most people simply learn through trial and error. Money is very important, it affects us all and can easily draw the line between heaven and hell. 85 percent of college graduates say they need help with financing. Avoid being one of them by following these five financial rules.

1. Create and follow a budget

To spend less than you earn is harder than it might sound, and nineteen percent of Americans spend more than they earn. Budgeting may seem like a drag, but being in debt is even more of a bummer. A budget help you get a hold of your spending, making it easier to build savings and improve your credit score so that you have enough savings for emergencies. If you do not follow this rule of thumb, your spending has the potential to turn into a downward circle that is hard to get out of. I recommend dividing your income according to the 50/20/30 rule:

- 50% of take-home pay goes toward your essentials as housing, utilities, transportation and groceries.

- 20% to debt repayment and future savings.

- 30% to everything else.

Are you eager to start today? “You need a budget” helps you gain control of you money.

2. Pay your debt

Debt is created to grow fast, and every time you are borrowing money your are stealing from your future self. You may meet the future with no money to use because it is already been spent so far in the past, and you might not even remember on what. Sadly the reality is, the future is always uncertain and your job, profession, or even the entire industry may or may not be there in the future.

As mentioned, paying off debt should be built into your budget and 20 percent of your take-home pay should be sat aside for it. If you use a credit card, a good rule is to pay it off in full every month and you will keep your credit score in the 760 range. By only paying the minimum amount, you will only be paying off the interest and not even touch the bulk of money you owe. The same applies for student loans and other loans.

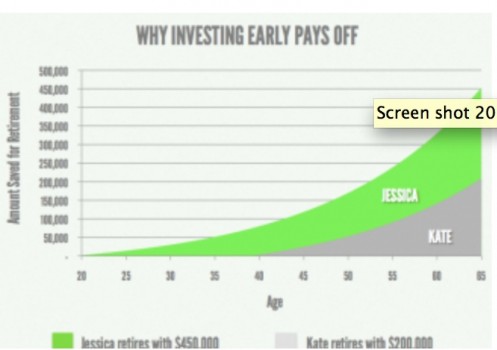

Alexa von Tobel´s graph picturing why starting early pays off.

3. Start saving for retirement

It may seems like retirement is decades from now, but the earlier you start saving,

the more time your investment has to grow. Many experts strongly advice you to start saving in your 20s, when you first leave school and start to earn paychecks. Each year´s gains can generate their own gains the next year. Starting to save in your 20s can make a huge difference versus starting to save when you reach your forties; a $30,000 investment can grow to more than $472,000 in 30 years, assuming an 8% annual return.

4. Keep emergency savings

An emergency fund should cover at least six month´s take-home pay. If anything goes wrong, this is your safety net that will save you from taking on any debt. Taking on more debt can hurt your financial future by gouging the credit score. The emergency savings can save your life if you loose your job, have a medical emergency, need to move, or if you figure out that you owe extra tax money. By saving a little bit each month you will not only be building a financial security, but also a peaceful mind.

So how much of the 20 percent allocated toward financial priorities should go into savings? Many people manage to put at least 20 percent of their net pay toward financial priorities, but a common problem is that outsized debt eats up most of the 20 percent. The best way to divide the 20 percent depends on the individual situation, but emergency savings and payments on high-interest debt should be a first priority. Retirement is a strong third, followed by other saving goals.

5. Negotiate your salary

Your starting salary puts the basis for all future raises, so the higher, the better for many years out. However, do not expect your boss to offer you a better salary for no reason, you have to negotiate it. Starting a few thousand dollars higher can lead to exponential benefits.

Your starting salary puts the basis for all future raises, so the higher, the better for many years out. However, do not expect your boss to offer you a better salary for no reason, you have to negotiate it. Starting a few thousand dollars higher can lead to exponential benefits.

“Forbes” offers some great advices on how to negotiate your salary.